MURFREESBORO, Tenn. — Tennessee consumers aren’t optimistic about their financial situations heading into the holiday season, according to results of the latest statewide Tennessee Consumer Outlook Index survey by Middle Tennessee State University’s Jones College of Business.

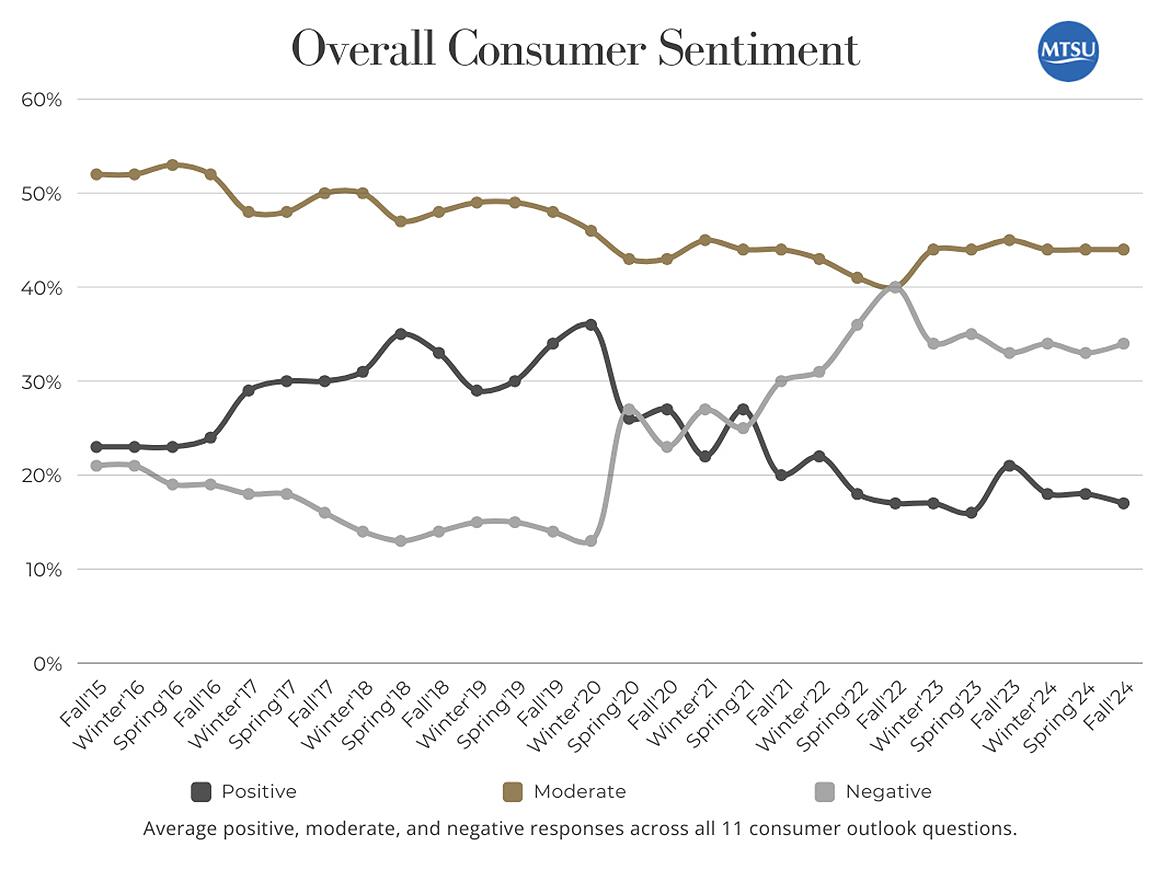

“Overall, sentiment remains mostly unchanged from earlier in 2024, as Tennessee consumers appear to be in a wait-and-see pattern due to mixed views on the future of the economy and the (recently held) presidential election,” noted assistant professor of marketing Michael Peasley, director of MTSU Office of Consumer Research, which coordinates the survey.

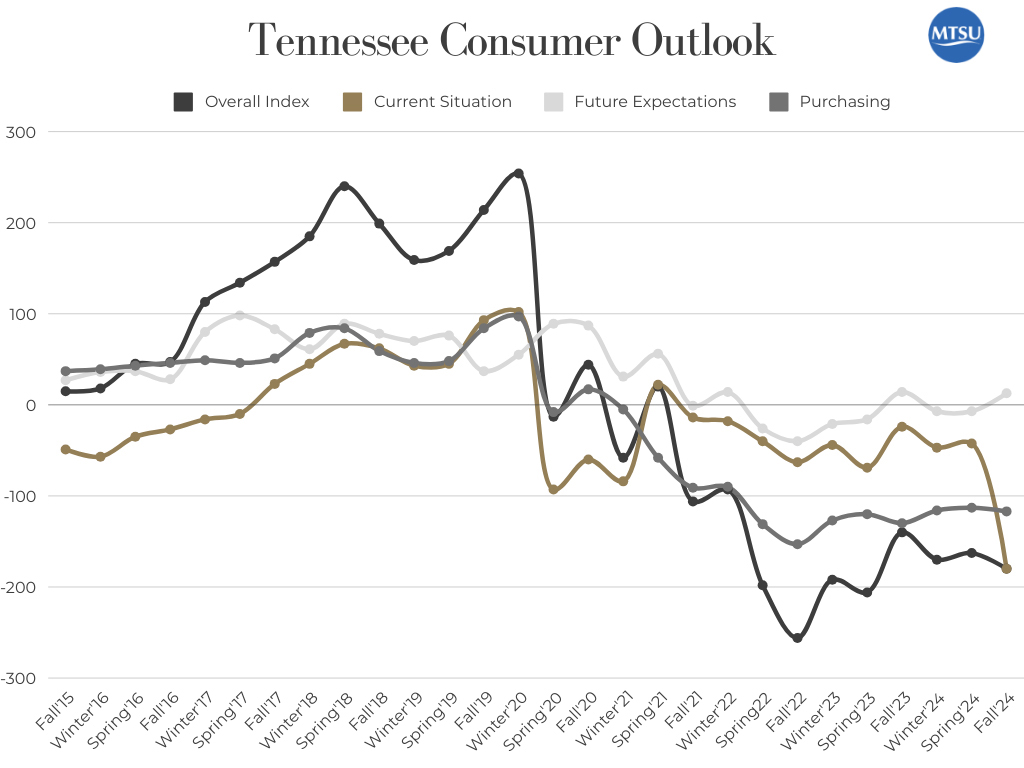

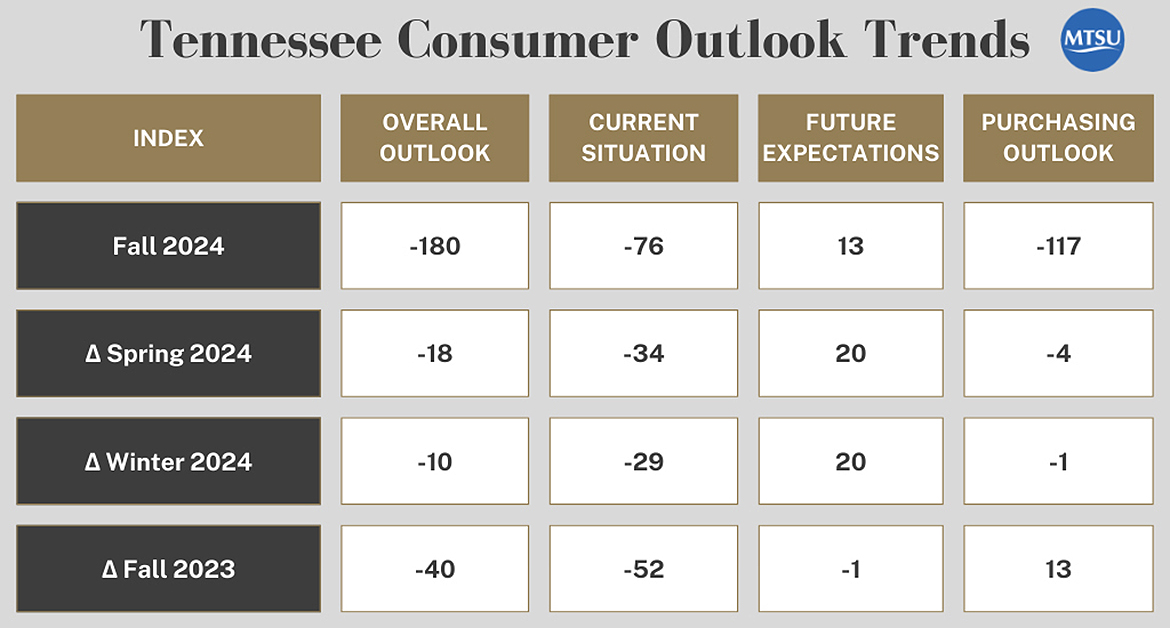

The latest survey index produced a score of -180, down from -162 in the spring.

The survey also revealed:

• Only 7.6% of consumers believe now is a good time to buy a house.

• Only 9.2% of consumers believe now is a good time to buy a car.

The overall index and its three sub-indices (Current, Future and Purchasing) are based on consumers’ responses to 11 questions measuring their perceptions of the current economy, the future economy, jobs, personal finances, and whether now is a good time to make large purchases.

According to survey results:

• In contrast to business sentiment, which is now at a three-year high of 42%, Tennessee consumers positive sentiment is only at 17%. (The business sentiment was recently revealed in results from MTSU’s latest Tennessee Business Barometer survey for fall.)

• Only 14.2% of respondents this quarter said that conditions in the U.S economy are positive and only 21.4% think that conditions will be better six months from now.

• Only 11% of Tennessee consumers said that their personal financial situation has improved over the last year, while 43% said it’s worse and 45% said it’s the same.

• 57% of Tennessee consumers said that they don’t believe they could survive financially if they lost their job, while only 17% think that they probably could survive loss of employment.

Consumers anticipate saving less, spending more

Even though the Federal Reserve cut interest rates in September, 76% of consumers are still concerned about inflation and are skeptical that the Federal Reserve has got inflation under control, Peasley noted.

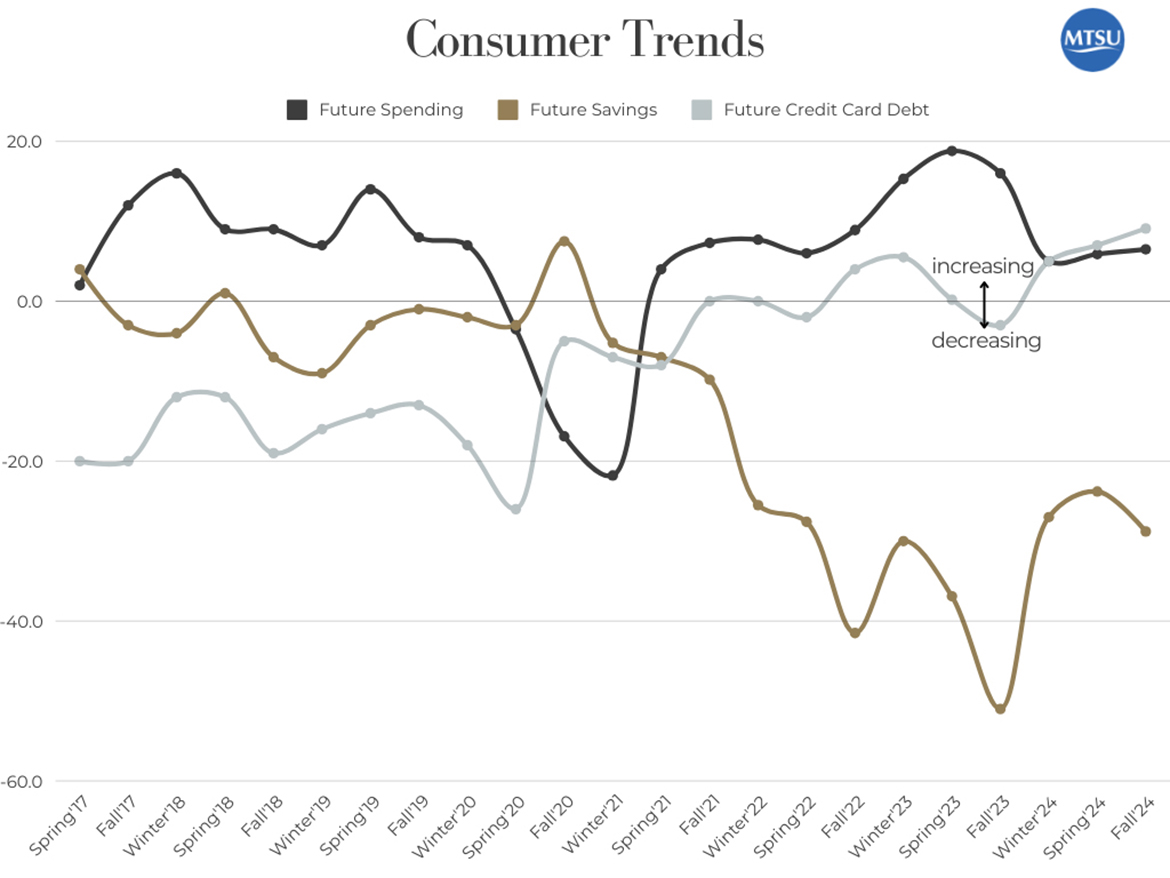

With wage increases lagging the increases in the cost of goods and services, some consumer spending is occurring at the expense of savings and through credit card debt, putting future spending at risk.

“While consumers anticipate spending more for goods and services, consumers do not believe now is a good time to make larger purchases,” Peasley continued. “More consumers anticipate in the next year that they will save less and their spending and credit card debt will increase.”

To see the full report and previous reports, which also includes consumer perceptions of state and national political leaders, go to https://www.mtsu.edu/consumer/tnoutlookreports.php.

About the Consumer Outlook Index

The Tennessee Consumer Outlook Index scores are based on consumers’ responses to 11 questions measuring their perceptions of the current economy, the future economy, jobs, personal finances, and whether now is a good time to make large purchases.

The index, which includes three subindices, is computed by adding the percentage of favorable responses to each question and subtracting the percentage of negative responses to each question. The inaugural Tennessee Consumer Outlook Index came in at 15, a score that serves as a baseline for subsequent indices. The all-time low of -256 came in fall 2022 while the all-time high of 254 came in winter 2019.

For more information, contact Michael Peasley at Michael.Peasley@mtsu.edu or 615-494-8992.

— Jimmy Hart (Jimmy.Hart@mtsu.edu)

COMMENTS ARE OFF THIS POST