Tennessee consumers remain deeply concerned about their financial prospects as they take a “wait-and-see approach” to state and national economies, according to the latest statewide survey by Middle Tennessee State University.

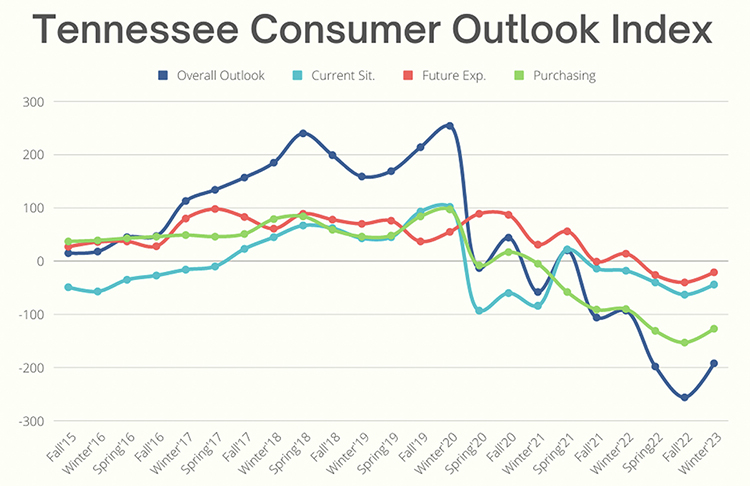

The Tennessee Consumer Outlook Index registered a score of -192 in March, an improvement from the all-time low of -256 in December 2022, reports the Office of Consumer Research in the Jennings A. Jones College of Business at MTSU.

Yet after expressing pessimism over the last several quarters, Tennessee consumers are showing signs of a slightly more positive — yet still very cautious — outlook on their economic situations.

To see the full report and previous reports, go to https://www.mtsu.edu/consumer/tnoutlookreports.php.

Bottom of fear or temporary optimism?

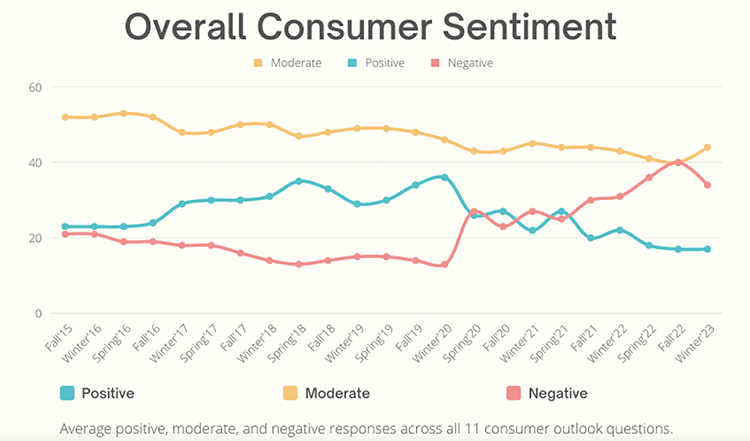

The Consumer Outlook’s Overall, Current Situation, Future Expectations, and Purchasing Indices rose to spring 2022 levels. Also this quarter, negative consumer sentiment declined from its peak of 40% to 34%. Meanwhile, positive sentiment remained unchanged.

“This reflects a belief that the current conditions are still relatively bad, and consumers are uncertain about future economic conditions,” noted Michael Peasley, new director of MTSU Office of Consumer Research and an assistant professor of marketing.

“While the current lows reflect poor views of the economy and pessimistic expectations for the future of the economy, the recent increases are likely signaling either the bottom of peak fear or temporary optimism as consumers wait for more economic news.”

With higher prices, a fluctuating stock market and recent banking failures, more respondents are worried (64.3%) about the economy than they are optimistic (19.3%).

Consumer spending steady, but …

Survey results also showed that over the past year, consumers’ willingness to spend money on large purchases has held relatively steady.

“Tennessee consumers appear to be in a wait-and-see pattern,” Peasley said. “Given that two-thirds of our national economy is from consumer spending, changes in consumers’ perceptions of the current economy, the future economy, and whether now is a good time to make large purchases can significantly affect future economic growth.”

Changes in consumer spending, savings and credit card debt are key indicators for predicting economic growth. With wages mostly stagnant, “consumers are increasing their spending (likely to keep up with inflation) and savings (likely to prepare for uncertain future economic conditions) at the expense of higher credit card debt,” Peasley noted in the survey summary.

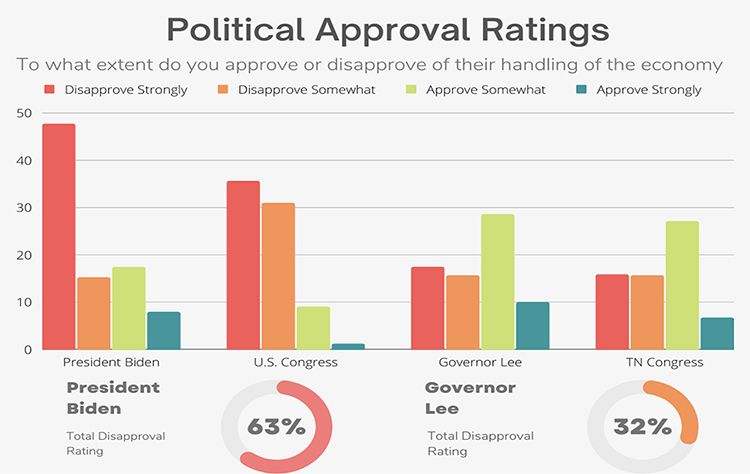

Mixed views of political leaders

Consumer ratings of political leaders handling of the economy remain relatively unchanged since our last survey.

• High disapproval of President Joe Biden (48% strongly, 15% somewhat disapprove)

• High disapproval of the U.S. Congress (36% strongly, 31% somewhat disapprove).

State political leader had more balanced ratings, with the highest number of respondents approving somewhat of their handling of the economy:

• Tennessee Gov. Bill Lee (17% strongly, 15% somewhat disapprove)

• Tennessee General Assembly (16% strongly, 16% somewhat disapprove)

About the Consumer Outlook Index

The Tennessee Consumer Outlook Index scores are based on consumers’ responses to 11 questions measuring their perceptions of the current economy, the future economy, jobs, personal finances, and whether now is a good time to make large purchases.

The index, which includes three subindices, is computed by adding the percentage of favorable responses to each question and subtracting the percentage of negative responses to each question. The inaugural Tennessee Consumer Outlook Index came in at 15, a score that serves as a baseline for subsequent indices.

For more information, contact Michael Peasley at Michael.Peasley@mtsu.edu or 615-494-8992.

— Jimmy Hart (Jimmy.Hart@mtsu.edu)

COMMENTS ARE OFF THIS POST