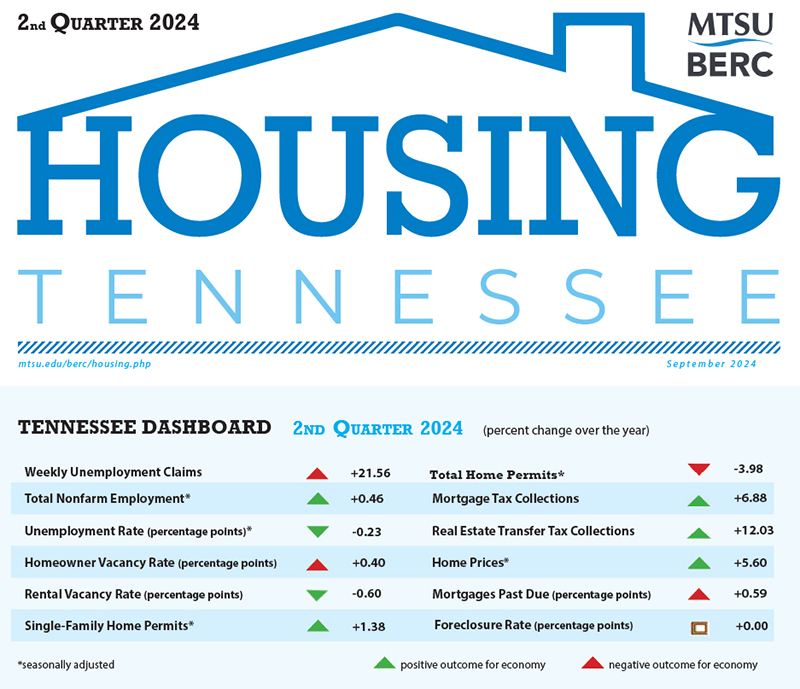

MURFREESBORO, Tenn. — With continued rising home prices and an emerging trend of fewer closings in some areas of the state during the second quarter of the year, Tennessee’s housing market presents mixed signals heading into the fall, according to the latest statewide report from Middle Tennessee State University.

“The housing market across Tennessee presents a complex and evolving landscape marked by regional disparities and mixed signals,” said Murat Arik, director of the MTSU Business and Economic Research Center in the Jones College of Business and author of its statewide report.

“While the state exhibits stronger house price growth than the national average — with a 5.6% annual increase — dynamics vary significantly among its metropolitan areas.”

As an example, Arik cited rising inventory levels across key Metropolitan Statistical Areas, or MSAs, such as Nashville and Memphis, “suggesting a cooling in some markets,” while Knoxville sees strong growth in both closings and available inventory.

Mortgage delinquency rates are climbing statewide and nationally, although foreclosure rates remain stable, “indicating financial strains that have yet to translate into significant foreclosures,” Arik noted.

See the full report and more detailed breakdowns at https://www.mtsu.edu/berc/housing/.

Other report highlights include:

• Permits mixed: There was a quarterly decline in single-family permits across all regions of the state, with single-family permits decreasing by 3% statewide; but single-family permits showed year-over-year growth across all regions, with a 1.4% increase statewide.

Meanwhile, multifamily permits saw a significant quarterly increase of 25.6% statewide but was down 12.7% annually to indicate “a more challenging picture” in that sector.

• Strong price growth: Several MSAs exhibit robust home price increases, the report shows, with the Jackson MSA (5.5% quarterly and 12.7% annually) and Kingsport-Bristol MSA (6% quarterly and 13.4% annually) showing the highest growth rates. The Johnson City MSA (5.2% quarterly and 9.7% annually) and Clarksville MSA (2.3% quarterly and 9.4% annually) also demonstrate significant annual gains.

Overall, Arik noted that Tennessee’s housing market “shows a mix of growth, stability, and caution. The state’s housing outlook is cautious optimism, grounded in a diverse and dynamic market.”

BERC’s report is funded by Tennessee Housing Development Agency, or THDA. The quarterly report offers an overview of the state’s economy as it relates to the housing market and includes data on employment, housing construction, rental vacancy rates, real estate transactions and mortgages, home sales and prices, delinquencies and foreclosures.

The Business and Economic Research Center operates under the Jennings A. Jones College of Business at MTSU. For more information, visit http://mtsu.edu/berc/.

About THDA

THDA is the state’s housing finance agency and is committed to expanding safe, sound, affordable housing opportunities for low- and moderate-income Tennesseans. This is achieved through a robust home loan program, competitive funding for local nonprofit and municipal agencies, and the administration of nine federally funded programs. THDA publishes research on affordable housing and THDA programs and beneficiaries. THDA also coordinates state planning for housing through the Consolidated Planning process, annual Action Plans, and annual Performance Reports. See http://thda.org for more information.

— Jimmy Hart (Jimmy.Hart@mtsu.edu)

COMMENTS ARE OFF THIS POST