Indications of the economic fallout from the COVID-19 shutdown in Tennessee is becoming evident now, according to the second quarter housing report from MTSU’s Business and Economic Research Center.

BERC’s analysis reveals that although the long-term consequences and the amount of time it will take for the economy to rebound have yet to be determined, the initial fallout from these events is evident in the second quarter data.

Dr. Murat Arik

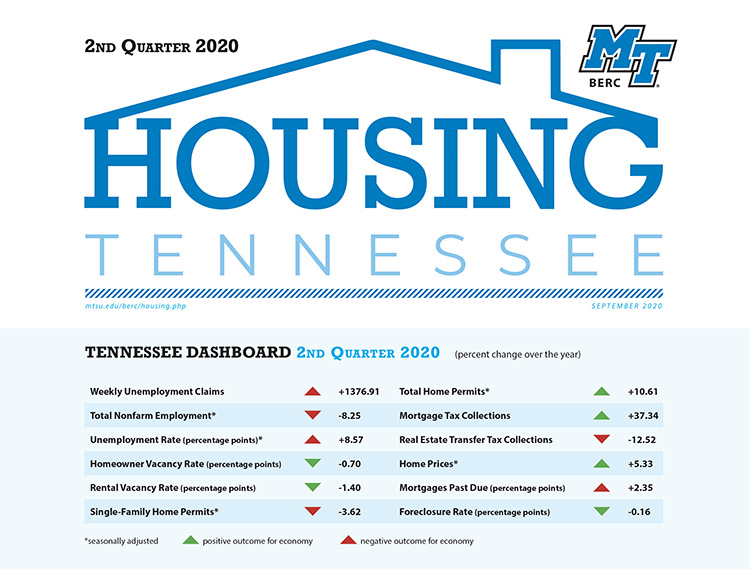

Economic indicators across the state of Tennessee are evenly split between positive and negative results. In quarterly comparisons, there was a substantial downturn in employment across all industries, closings in home sales across all areas, and single-family housing permits.

However, there are a few highlights worth pointing out: homeowner and rental vacancy rates in Tennessee both fell over the year, and the foreclosure rate dropped over the quarter and year. Also, home prices increased across all of the state’s Metropolitan Statistical Areas, or MSAs.

“The most substantial positive outcomes are increases in mortgage tax collections and total home permits” at 37% and 10.6% respectively, noted report author Murat Arik, director of the BERC.

“The negative results from this quarter are severe, especially the unparalleled rise in initial unemployment claims,” Arik added.

This chart shows year-over-year changes in the second quarter performance of the Tennessee housing market. (Courtesty of the MTSU Business and Economic Research Center)

• In the first week of April, unemployment claims spiked to 112,186. Claims have slowly tapered, coming to 21,544 in the last week of June. Although this number is much lower than that of the first week of April, it is still much higher than the 2,702 claims filed in the second week of March, before pandemic response measures were put in place.

“Employment dropped across every industry as businesses shut down,” Arik stated. The hardest-hit sector in Tennessee was manufacturing, which saw a decrease of 13.5% in employment over the quarter and almost 14% over the year. Compared to the first quarter of 2020, total employment fell by almost 13% and the unemployment rate surged by 8.7 percentage points.

• In home sales, quarterly comparisons for Nashville, Knoxville, and Memphis show decreases in closings. Nashville saw a 14.80% decline; Knoxville, a 12.06% decline; and Memphis, a 16.59% decline. All areas also saw a drop in inventory over the quarter. For Nashville, this was a decrease of 3.17%; for Knoxville, 14.46%; and for Memphis, 10.71%.

• In an analysis of home prices from the previous year, Tennessee experienced an increase of 5.3%, continuing their upward trend and surpassing the national yearly increase of 4.0%. Likewise, all MSAs encountered growing home prices, three of which saw steeper growth than Tennessee.

Although every region experienced increases in housing prices, the rate of growth slowed across all regions when compared to last quarter.

• In the second quarter of 2020, the number of mortgages past due jumped substantially in Tennessee. Mortgage delinquencies rose to 7.35%, representing a 3 percentage point increase from the previous quarter. Percentages this high have not been seen in Tennessee since the end of 2014.

• The foreclosure rates in Tennessee and the U.S. decreased by 0.15 percentage points and 0.16 percentage points, respectively, bringing the rates of both to 0.03%. As with mortgage delinquencies, these values are a significant divergence from the rates seen in recent years.

• The foreclosure rates in Tennessee and the U.S. decreased by 0.15 percentage points and 0.16 percentage points, respectively, bringing the rates of both to 0.03%. As with mortgage delinquencies, these values are a significant divergence from the rates seen in recent years.

Overall, the data from the second quarter of 2020 reflects the volatility caused by the pandemic. “Such a large volume of initial unemployment claims in a contracted time period has not been seen before,” Arik noted.

Similarly, “an increase in the unemployment rate, which climbed 8.7 percentage points, has not occurred since the last economic recession,” he added.

About the BERC housing report

BERC’s Housing Tennessee report is funded by Tennessee Housing Development Agency (THDA). The quarterly report offers an overview of the state’s economy as it relates to the housing market and includes data on employment, housing construction, rental vacancy rates, real estate transactions and mortgages, home sales and prices, delinquencies and foreclosures.

The Business and Economic Research Center operates under the Jennings A. Jones College of Business at MTSU.

THDA is the state’s housing finance agency and is committed to expanding safe, sound, affordable housing opportunities for low- and moderate-income Tennesseans. This is achieved through a robust home loan program, competitive funding for local nonprofit and municipal agencies, and the administration of nine federally funded programs. THDA publishes research on affordable housing and THDA programs and beneficiaries. THDA also coordinates state planning for housing through the Consolidated Planning process, annual Action Plans, and annual Performance Reports.

— Brian Delaney (Brian.Delaney@mtsu.edu)

COMMENTS ARE OFF THIS POST