Signs of positive momentum can be seen in Tennessee’s third quarter housing data following the economic impact of the COVID-19 pandemic.

Several indicators, such as housing construction, home sales, and home prices, are showing strong outcomes this period, according to the research report completed by MTSU’s Business and Economic Research Center.

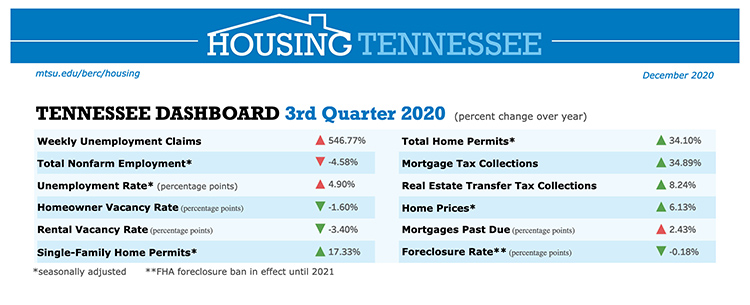

This chart shows year-over-year changes in the third quarter performance of the Tennessee housing market. (Courtesty of the MTSU Business and Economic Research Center)

• PERMITS: Third-quarter housing construction data in Tennessee is promising, showing growth for all permit types when compared to the previous quarter and year. The data reveals single-family and total home permits have jumped in number from last year, by 17.3% and 34%, respectively. Additionally, mortgage tax collections have increased by almost 35% over the year.

Dr. Murat Arik

• HOME SALES: In home sales, quarterly comparisons for Nashville, Knoxville and Memphis show that there has been a significant uptick in closings. Nashville’s closings show the most significant quarterly increase, at 27.4%, Knoxville’s closings increased 25.4%, and Memphis’ closings increased 20.5%. Inventory has decreased in all regions for the quarter: Nashville (-16.8%), Knoxville (-22.5%), and Memphis (-15%).

• HOME PRICES: Home prices in Tennessee and the United States continued climbing throughout the third quarter. Tennessee experienced a 6% increase in prices, compared to the U.S., which saw an increase of 4.7%. All of Tennessee’s MSAs also had upswings in home prices, with Chattanooga MSA, Clarksville MSA, and Cleveland MSA having the most substantial growth.

• EMPLOYMENT: However, some indicators are rebounding more slowly, noted report author Murat Arik, director of the BERC. Weekly initial claims for unemployment insurance remain at record highs, averaging at 15,406 for the quarter. Although this amount reveals a significant improvement from the second quarter (-61.25%), it is a 546.77% increase compared to 2019. Claim numbers gradually dwindled, going from 24,920 in the first week of the period to 10,311 in the last week.

Employment levels across all industries are down from 2019 numbers but are higher than last quarter. The manufacturing industry was the most negatively affected sector, as it sustained a decrease of 8.8% over the year, but it also improved the most over the quarter, as numbers increased by 6%. Total employment rose by 6.4% over the quarter, and the unemployment rate fell by 3.77 percentage points over the quarter.

• FORECLOSURES: In an analysis of foreclosure data, the current indication does not provide an accurate assessment of conditions, Arik noted.

“For the U.S. and Tennessee, the foreclosure rate stagnated at 0.3%. It is important to note that foreclosure rates are artificially low because of the foreclosure ban on the single-family mortgages insured by the Federal Housing Administration,” Arik stated.

About the BERC housing report

BERC’s Housing Tennessee report is funded by Tennessee Housing Development Agency. The quarterly report offers an overview of the state’s economy as it relates to the housing market and includes data on employment, housing construction, rental vacancy rates, real estate transactions and mortgages, home sales and prices, delinquencies and foreclosures.

BERC’s Housing Tennessee report is funded by Tennessee Housing Development Agency. The quarterly report offers an overview of the state’s economy as it relates to the housing market and includes data on employment, housing construction, rental vacancy rates, real estate transactions and mortgages, home sales and prices, delinquencies and foreclosures.

The Business and Economic Research Center operates under the Jennings A. Jones College of Business at MTSU.

THDA is the state’s housing finance agency and is committed to expanding safe, sound, affordable housing opportunities for low- and moderate-income Tennesseans. This is achieved through a robust home loan program, competitive funding for local nonprofit and municipal agencies, and the administration of nine federally funded programs. THDA publishes research on affordable housing and THDA programs and beneficiaries. THDA also coordinates state planning for housing through the Consolidated Planning process, annual Action Plans, and annual Performance Reports.

— Brian Delaney (Brian.Delaney@mtsu.edu)

COMMENTS ARE OFF THIS POST