MURFREESBORO, Tenn. — Middle Tennessee State University’s latest “Housing Tennessee” report shows a mix of positive, concerning results for the state’s housing market amid strong economic indicators heading into the spring.

With strong employment numbers, the MTSU Business and Economic Research Center’s statewide report for the fourth quarter of 2023 “is navigating a phase characterized by various factors leaning toward a more positive trajectory” overall, noted report author Murat Arik, director of the BERC at MTSU.

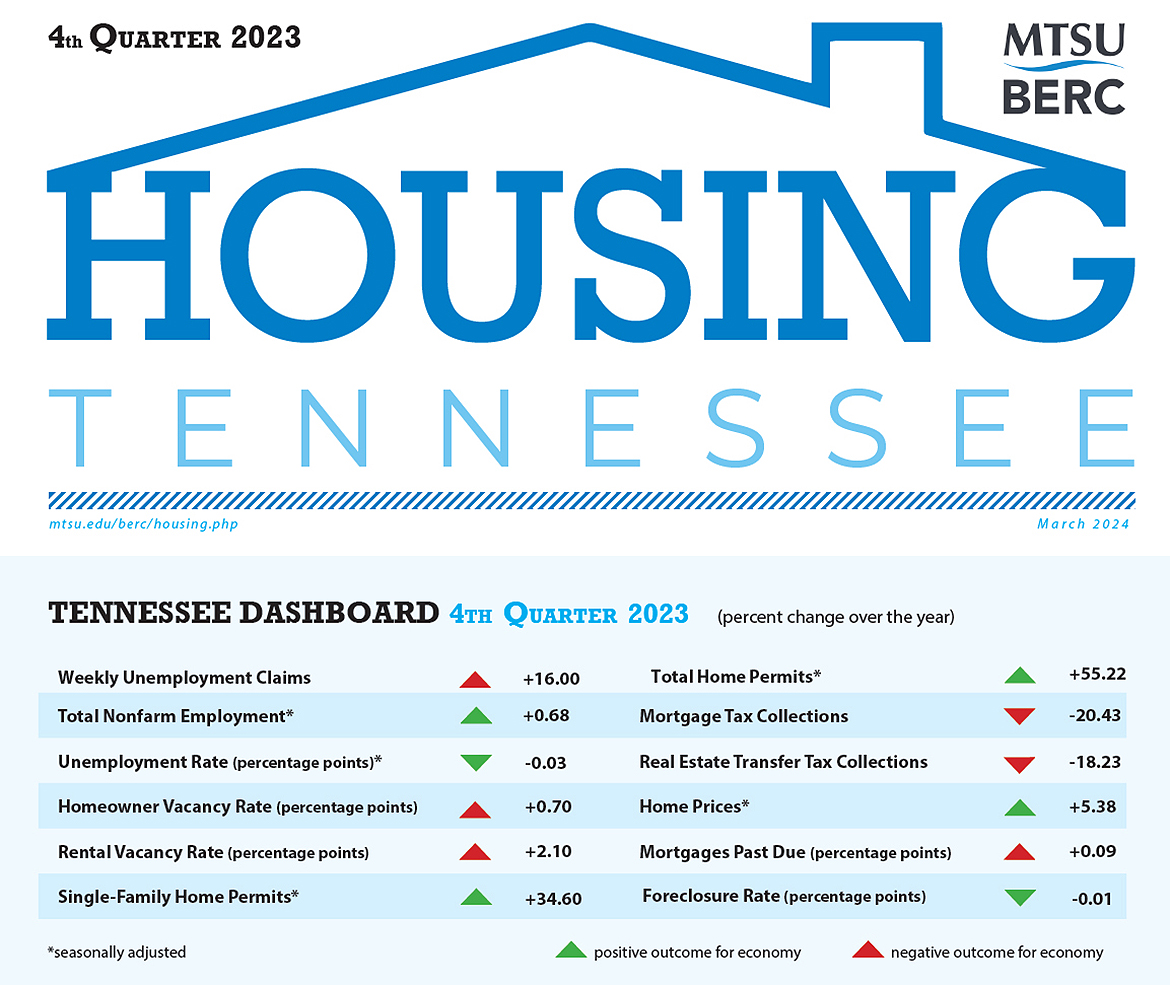

While economic indicators such as weekly jobless claims, homeowner and rental vacancy rates as well as mortgage and real estate tax collections “suggested economic strains,” positive trends were found in rising overall employment, “a significant uptick” in single-family and total home permits, and home prices continuing to increase (up 5.4% annually).

Report highlights include:

• Single-family permits in Tennessee, the South and the nation showed significant quarterly growth and annual growth — up 3.4%, 2% and 3.3% respectively for the quarter, and 34.6%, 25% and 26% annually. Meanwhile, multi-family permits were mixed, with all regions showing noticeably drops quarter between 15% and 25%, but with Tennessee showing an eye-popping 141% increase annually, while the South and U.S. showed drops (24.6% and 19% respectively.)

• Home prices for all Tennessee Metropolitan Statistical Areas, or MSAs, “showed a consistent upward trajectory,” Arik noted. Notably, the Cleveland, Tennessee, MSA exhibited the highest annual increase (14.8%), while Memphis observed the most modest (0.66%). The Chattanooga and Johnson City MSAs reported annual growth of 11.3% and 10%, respectively.

Meanwhile, Tennessee’s overall home prices rose by 2%, slightly surpassing the U.S. average quarterly growth of 1.3%, while annually, Tennessee’s home price growth stood at 5.4%, compared to the national rate of 5.65%.

• Home sales were “reflected diverse trends” across the state’s regions, with the Memphis area witnessing a significant increase of 10%, while Knoxville and Nashville experienced declines of 0.6% and 5.2%, respectively. Conversely, the regions displayed a declining trend in annual home sales closings. Knoxville saw the most notable decline (7.4%), followed by Nashville (3.5%) and Memphis (2%).

• Tennessee saw “significant annual and quarterly fluctuations” in homeowner vacancy rates, up .7 percentage points annually, yet down .3 percentage points quarterly. Rental vacancy rates showed notable jumps annually (2.1 percent points) and quarterly (1.6 percentage points).

• Mortgage delinquency rates and foreclosures in Tennessee annually and quarterly mirror the overall U.S. picture, with slight increases in some areas and slight decreases or stability in others.

“While resilience and growth are evident in some metrics, vigilance is warranted to address potential economic challenges. Continuous monitoring and strategic measures will be essential in navigating the evolving landscape of Tennessee’s housing market,” Arik noted.

See the full report and more detailed breakdowns at https://www.mtsu.edu/berc/housing/.

BERC’s report is funded by Tennessee Housing Development Agency, or THDA. The quarterly report offers an overview of the state’s economy as it relates to the housing market and includes data on employment, housing construction, rental vacancy rates, real estate transactions and mortgages, home sales and prices, delinquencies and foreclosures.

The Business and Economic Research Center operates under the Jennings A. Jones College of Business at MTSU. For more information, visit http://mtsu.edu/berc/.

About THDA

THDA is the state’s housing finance agency and is committed to expanding safe, sound, affordable housing opportunities for low- and moderate-income Tennesseans.

This is achieved through a robust home loan program, competitive funding for local nonprofit and municipal agencies, and the administration of nine federally funded programs. THDA publishes research on affordable housing and THDA programs and beneficiaries.

THDA also coordinates state planning for housing through the Consolidated Planning process, annual Action Plans, and annual Performance Reports. See http://thda.org for more information.

— Jimmy Hart (Jimmy.Hart@mtsu.edu)

COMMENTS ARE OFF THIS POST