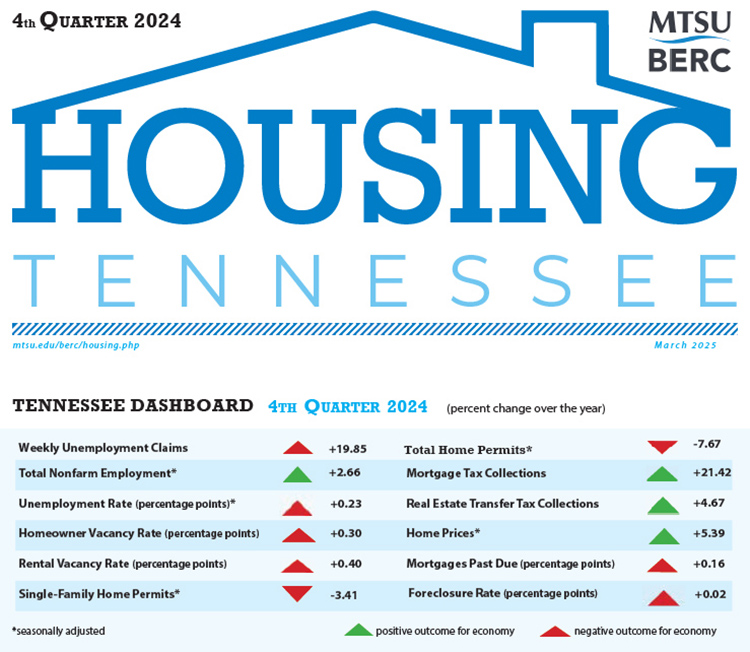

MURFREESBORO, Tenn. — Tennessee’s housing market showed “mixed growth” for the fourth quarter of 2024 as home prices continue to rise in some areas, while homeowner vacancy rates and total home permits decreased, according to the latest statewide report from Middle Tennessee State University.

“Looking ahead, national policy changes are expected to impact regional sectors, but the extent of these effects will become clearer in the coming quarters,” said Murat Arik, director of the MTSU Business and Economic Research Center in the Jones College of Business and author of its statewide report for the fourth quarter of 2024.

Home prices rose by 0.74% from the previous quarter and 5.4% annually statewide, surpassing the national growth rates (flat quarterly and 4% annually.) Strong price increases were seen in markets like Jackson and Cleveland, while Clarksville and Memphis experienced price declines.

Nashville‘s housing market showed positive results in the fourth quarter of 2024, with home closings increasing by 5.33% quarterly and 12% annually, “reflecting steady demand for homes in the area.,” Arik noted.

See the full report and more detailed breakdowns, including employment data, at https://www.mtsu.edu/berc/housing/.

Other report highlights on prices include:

• Strong growth areas: In the Jackson MSA, home prices increased by 3% from the previous quarter and 8.4% rise year-over-year. Similarly, the Cleveland MSA experienced a 1.8% increase in house prices quarterly, with a 5.7% increase year-over-year.

• Moderate growth areas: The Kingsport-Bristol MSA saw a 1.5% rise in house prices compared to the previous quarter, and a 6.84% increase year-over-year. The Johnson City MSA showed similar trends with a rise of 1.5% quarterly and 8.2% annually.

• Mixed, slower growth areas: In the Knoxville MSA, house prices grew by 0.65% from the previous quarter and 7.2% annually. The Morristown MSA saw a 0.54% quarterly increase and a 7% rise year-over-year. Chattanooga MSA had the least growth, with a 0.42% quarterly increase and a 4.3% annual rise in home prices.

• Declining areas: The Clarksville MSA experienced a decline in home prices, with a 1% drop from the previous quarter, although it still saw a slight 0.15% increase annually. The Memphis MSA also saw a quarterly decrease of 0.6% but experienced a 2.2% annual increase. Similarly, the Nashville MSA had a small decline of 0.12% quarterly, with a 4.3% annual increase.

BERC’s report is funded by Tennessee Housing Development Agency, or THDA. The quarterly report offers an overview of the state’s economy as it relates to the housing market and includes data on employment, housing construction, rental vacancy rates, real estate transactions and mortgages, home sales and prices, delinquencies and foreclosures.

The Business and Economic Research Center operates under the Jennings A. Jones College of Business at MTSU. For more information, visit http://mtsu.edu/berc/.

About THDA

THDA is the state’s housing finance agency and is committed to expanding safe, sound, affordable housing opportunities for low- and moderate-income Tennesseans. This is achieved through a robust home loan program, competitive funding for local nonprofit and municipal agencies, and the administration of nine federally funded programs.

THDA publishes research on affordable housing and THDA programs and beneficiaries. THDA also coordinates state planning for housing through the Consolidated Planning process, annual Action Plans, and annual Performance Reports. See http://thda.org for more information.

— Jimmy Hart (Jimmy.Hart@mtsu.edu)

COMMENTS ARE OFF THIS POST