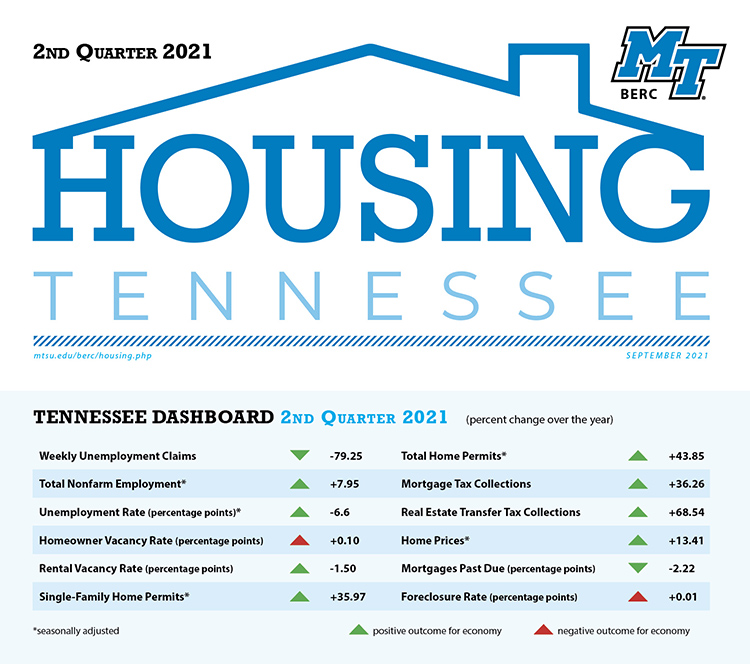

In a new economic report from Middle Tennessee State University, the state’s housing market continues to show signs of a continued recovery from the impact of COVID-19.

The MTSU Business and Economic Research Center’s statewide analysis for the second quarter “showed mostly positive outcomes,” with home sales increasing overall from the previous quarter and home prices up from the previous year across the state, noted report author Murat Arik, director of the BERC at MTSU.

Dr. Murat Arik

“Housing prices for the U.S. and Tennessee seem to follow a pattern of exponential growth, while mortgage delinquencies inch closer to pre-pandemic levels, and foreclosures remain slightly above zero percent,” Arik said.

• Home Sales: Closings for the Nashville, Knoxville, and Memphis regions had mixed outcomes for the quarter and year. Nashville and Knoxville had decreases in quarterly closings of .01% and 17.6%, while Memphis saw a quarterly increase of 3.5%. When considering annual changes, all three regions in the state experienced growth: Nashville at 25.5%, Knoxville at 20%, and Memphis at 28%.

Inventory among the three regions almost uniformly decreased from both quarterly and yearly perspectives. Knoxville saw the only quarterly increase of 18.77%. Nashville and Memphis saw a quarterly decline in inventory by 16% and 3.26%, respectively. Annual changes were strictly negative among Nashville at 55%, Knoxville at 48.3%, and Memphis at 33.7%.

• Home Prices: Among the major metropolitan statistical areas in Tennessee, all saw increases in home prices. Morristown, Jackson, and Knoxville MSAs had the largest annual growth rate (16.7%, 15.3%, and 15%, respectively). All MSAs also saw an increase in home prices from the previous quarter. Morristown, Jackson, and Knoxville MSAs had quarterly growth (6.24%, 8.8%, and 6.8% respectively).

• Single-family and total home permits for Tennessee were more mixed. Single-family permits slightly fell by .2%, and total permits rose by 12% since Q1 2021. Both categories of permits saw significant increases since the second quarter of 2020. Single-family permits rose by 36% and total family permits rose by 44%.

Overall, with the exception of single-family permits, Tennessee’s economy is experiencing a continued recovery from the COVID-19 pandemic.

Find a more detailed summary of the Q2 report here.

BERC’s report is funded by Tennessee Housing Development Agency, or THDA. The quarterly report offers an overview of the state’s economy as it relates to the housing market and includes data on employment, housing construction, rental vacancy rates, real estate transactions and mortgages, home sales and prices, delinquencies and foreclosures.

BERC’s report is funded by Tennessee Housing Development Agency, or THDA. The quarterly report offers an overview of the state’s economy as it relates to the housing market and includes data on employment, housing construction, rental vacancy rates, real estate transactions and mortgages, home sales and prices, delinquencies and foreclosures.

The Business and Economic Research Center operates under the Jennings A. Jones College of Business at MTSU. For more information, visit http://mtsu.edu/berc/.

About THDA

THDA is the state’s housing finance agency and is committed to expanding safe, sound, affordable housing opportunities for low- and moderate-income Tennesseans. This is achieved through a robust home loan program, competitive funding for local nonprofit and municipal agencies, and the administration of nine federally funded programs. THDA publishes research on affordable housing and THDA programs and beneficiaries. THDA also coordinates state planning for housing through the Consolidated Planning process, annual Action Plans, and annual Performance Reports. See http://thda.org for more information.

— Brian Delaney (Brian.Delaney@mtsu.edu)

COMMENTS ARE OFF THIS POST