Middle Tennessee State University’s latest “Housing Tennessee” report shows “mixed economic outcomes” for a housing market that remains strong but showed signs of cooling in the second quarter of the year.

The MTSU Business and Economic Research Center’s statewide report for the second quarter of 2022 shows challenges regarding total and single-family home permits as well as rental vacancy rates and foreclosure rates, noted report author Murat Arik, director of the BERC at MTSU.

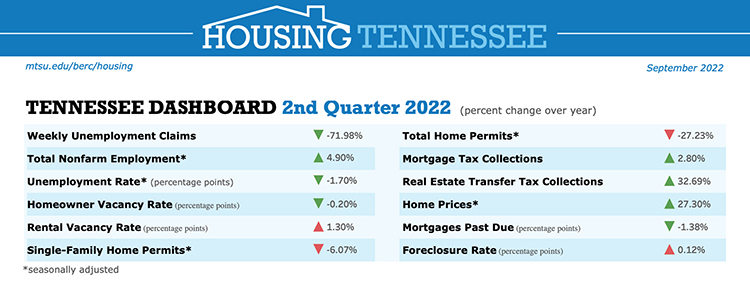

But coupled with strong jobless numbers (unemployment claims fell 72% from last year), the housing market showed positive signs regarding homeowner vacancy rates, mortgage tax collections, home prices and mortgages past due.

Key report highlights:

• Tennessee home prices continue to trend upward for all MSAs in Tennessee. For the second quarter, the Clarksville MSA saw the most significant increase in home prices from last year (30.5%), with the Nashville MSA closely behind (30.4%). The smallest increases were recorded in the Memphis MSA (20.6%) and Morristown MSA (21.3%).

• Tennessee’s single-, multi-family and total home permits all fell both quarterly and yearly. The state recorded quarterly and annual decreases of 18% and 27.2%, respectively.

• Closings for the Nashville, Knoxville, and Memphis regions “were a combination of increases and decreases” from the previous quarter. The Nashville area saw the most significant drop (4.3%), while the Knoxville and Memphis areas recorded closing increases (1.7% and 2.9%, respectively). Year-over-year changes were most significant for Nashville (-5.64%). Knoxville and Memphis experienced more modest changes, with a 0.4% increase in Knoxville and 0.6% drop in Memphis.

Arik noted that “a sign of uneasiness emerged in the corners of the housing market as reflected in significant drops in housing permit activities in Tennessee. It is also important to note that, albeit slight, the annual increase in foreclosure rates suggests an emerging sign of trouble for some homeowners.”

See the full report and more detailed breakdowns at https://www.mtsu.edu/berc/housing/.

BERC’s report is funded by Tennessee Housing Development Agency, or THDA. The quarterly report offers an overview of the state’s economy as it relates to the housing market and includes data on employment, housing construction, rental vacancy rates, real estate transactions and mortgages, home sales and prices, delinquencies and foreclosures.

The Business and Economic Research Center operates under the Jennings A. Jones College of Business at MTSU. For more information, visit http://mtsu.edu/berc/.

About THDA

THDA is the state’s housing finance agency and is committed to expanding safe, sound, affordable housing opportunities for low- and moderate-income Tennesseans. This is achieved through a robust home loan program, competitive funding for local nonprofit and municipal agencies, and the administration of nine federally funded programs. THDA publishes research on affordable housing and THDA programs and beneficiaries. THDA also coordinates state planning for housing through the Consolidated Planning process, annual Action Plans, and annual Performance Reports. See http://thda.org for more information.

— Jimmy Hart (Jimmy.Hart@mtsu.edu)

COMMENTS ARE OFF THIS POST