MURFREESBORO, Tenn. — Middle Tennessee State University’s Office of Consumer Research is taking a closer look at the state’s housing and real estate market from the perspective of buyers, sellers and homeowners.

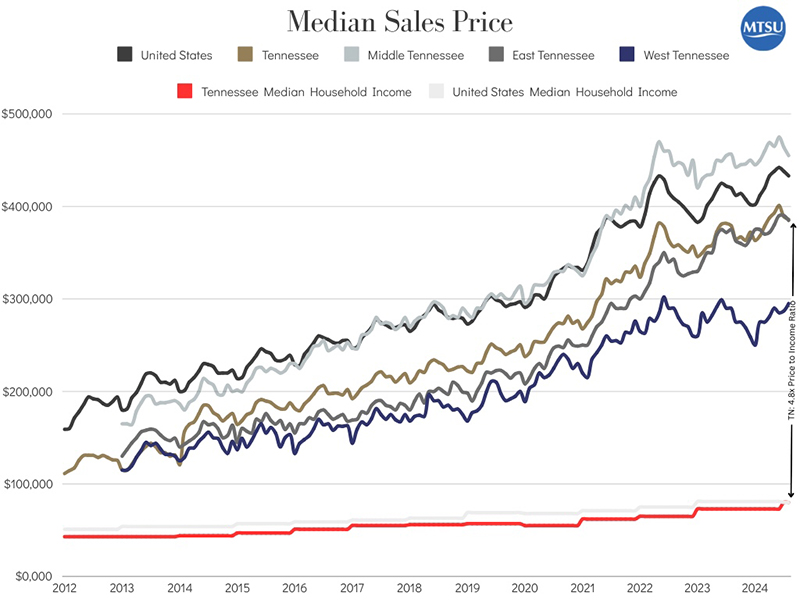

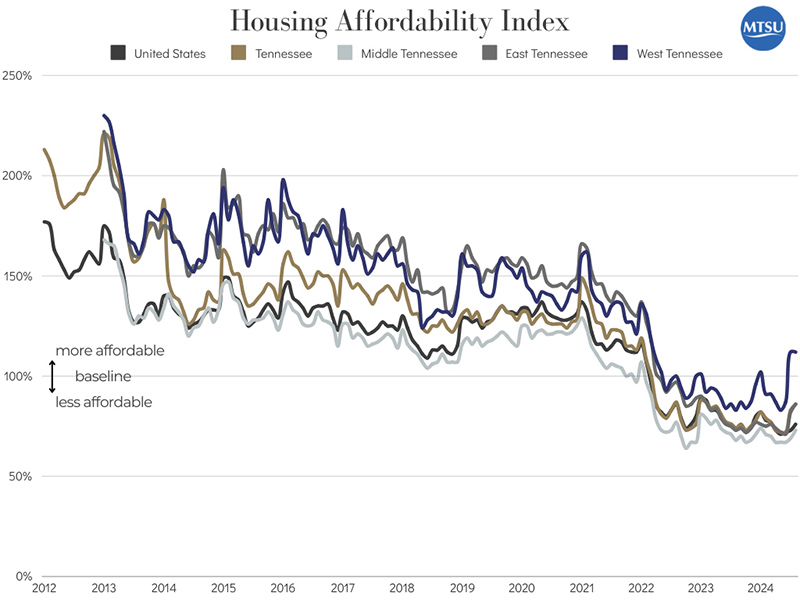

The first edition of the office’s Tennessee Housing Market Report shows that although the median sales price of homes in Tennessee has dropped almost 4% from a June high of $401,000, “median sales prices still feel expensive considering that prices have increased by 44% since January 2021 and 6% within the past year,” noted report author Michael Peasley, director of the office within the Jones College of Business and associate professor of marketing.

“In line with these price increases, our most recent consumer survey shows only 7% of Tennessee consumers believe now is a good time to buy a house,” Peasley added.

Other highlights:

Monthly payments dip with rate cuts on horizon

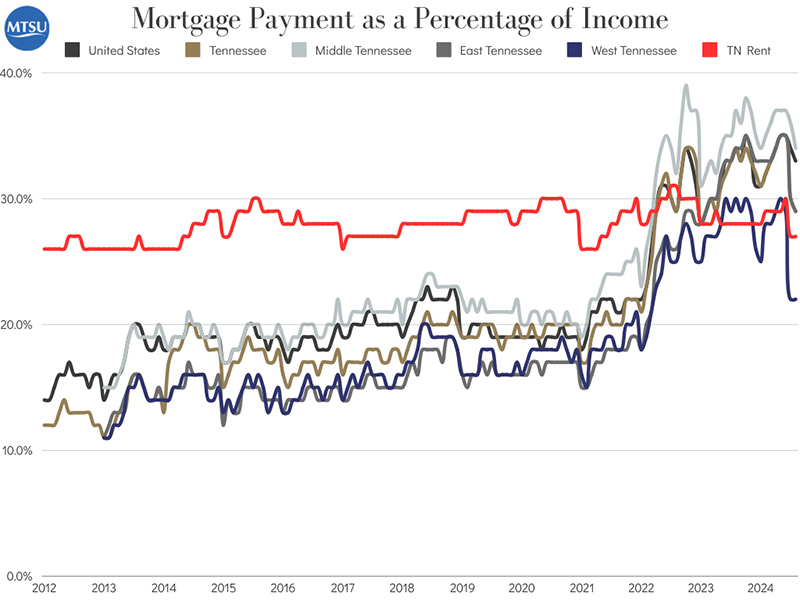

• The median mortgage payment in Tennessee is down 7.6% to $1,952 from the June 2024 high of $2,113. However, consumers still feel that home prices are expensive, in part because payments have increased by 125% since January 2021.

• The median mortgage payment is now 30% of household income in Tennessee, down from 35% in June 2024, but up 71% from the four-year low of 17% in January of 2021.

Days on market, housing supply begin seasonal increase

• The days on market for homes in Tennessee increased by 12% to 55 days in August from the June 2024 low of 49 days, which is 17% higher than August 2023, providing data on a potential trend to pay attention to in the fall and winter seasons.

• Similarly, there is currently 3.5 months of inventory on the market, an increase of 22% from 2.9 than August 2023.

About the report

The Housing Market Report is based on data compiled from the St. Louis Federal Reserve, U.S. Census Bureau, and the Redfin Data Center. (Note: The median mortgage payment is calculated using the median sales price with a 20% down payment.)

In addition to the Housing Market Report, the Office of Consumer Research collects data throughout the year to measure Tennessee consumers’ and business leaders’ perceptions of the economy, which can be found at mtsu.edu/consumer.

For more information, contact Peasley at michael.peasley@mtsu.edu.

— Jimmy Hart (Jimmy.Hart@mtsu.edu)

COMMENTS ARE OFF THIS POST