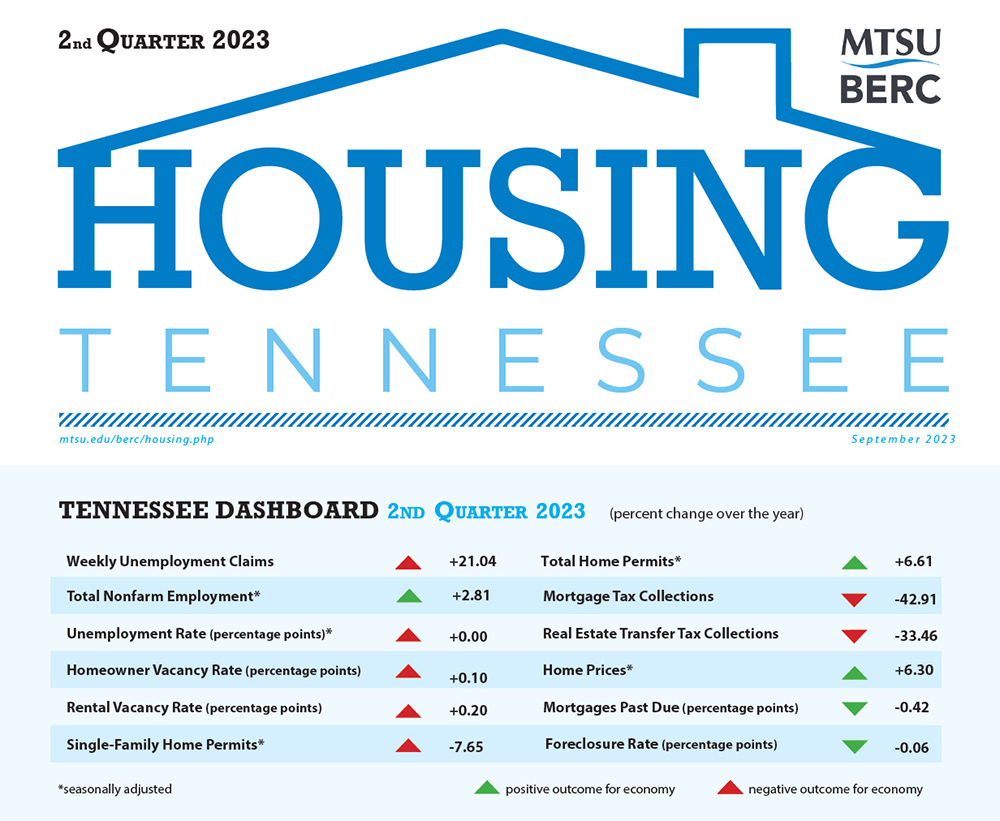

Middle Tennessee State University’s latest “Housing Tennessee” report shows a continued uptick in home prices across the state amid mixed results for single- and multi-family permits.

The MTSU Business and Economic Research Center’s statewide report for the second quarter of 2023 reveals a continued trend from the first quarter with housing inventory on the rise for the large metropolitan areas year-over-year, with Nashville showing the most significant growth of 60.7%, noted report author Murat Arik, director of the BERC at MTSU.

Report highlights include:

• Home sales were varied for the Nashville, Knoxville, and Memphis regions. Quarterly closings decreased by .06% in Nashville and 3.3% in Memphis while it slightly increased by 0.07% in Knoxville. Annually, closings declined by 20% in Nashville, 16.7% in Knoxville, and 29% in Memphis.

• Home prices for all Tennessee MSAs rose year-over-year, with the Knoxville MSA seeing the most significant increase of 11.4%, while the Clarksville MSA had the smallest annual growth of 0.7%. Meanwhile, Nashville and Memphis saw annual growth of 3.4% and 5%, respectively.

Annually, prices for Tennessee and the United States grew by 6.3% and 4.3%, respectively.

“Compared to last year, Tennessee’s previously rapid home price growth began to slow down. This shift marked a return to more typical pre-pandemic conditions, signaling a healthier and more stable housing market,” Arik noted.

• Total home construction permits saw increases quarterly and annually, which could indicate growth in other types of housing construction. Although single-family permits were up 20.6% from the previous quarter, the year-over-year decrease indicates a potential slowdown in new construction in this category, Arik noted.

• While mortgage delinquencies and foreclosure rates increased slightly from the previous quarter, annually they dropped for Tennessee and the United States.

See the full report and more detailed breakdowns at https://www.mtsu.edu/berc/housing/.

BERC’s report is funded by Tennessee Housing Development Agency, or THDA. The quarterly report offers an overview of the state’s economy as it relates to the housing market and includes data on employment, housing construction, rental vacancy rates, real estate transactions and mortgages, home sales and prices, delinquencies and foreclosures.

The Business and Economic Research Center operates under the Jennings A. Jones College of Business at MTSU. For more information, visit http://mtsu.edu/berc/.

About THDA

THDA is the state’s housing finance agency and is committed to expanding safe, sound, affordable housing opportunities for low- and moderate-income Tennesseans. This is achieved through a robust home loan program, competitive funding for local nonprofit and municipal agencies, and the administration of nine federally funded programs. THDA publishes research on affordable housing and THDA programs and beneficiaries. THDA also coordinates state planning for housing through the Consolidated Planning process, annual Action Plans, and annual Performance Reports. See http://thda.org for more information.

— Jimmy Hart (Jimmy.Hart@mtsu.edu)

COMMENTS ARE OFF THIS POST