A student team of business majors at Middle Tennessee State University proved that their market analysis skills are comparable to those of Wall Street veterans with stellar results in the most recently completed TVA Investment Challenge.

After starting last year with a half-million-dollar stock portfolio to manage, MTSU’s student team in the Jennings A. Jones College of Business finished with “a stunning 24.6% return, bringing the balance of the portfolio to more than $623,000,” said Kevin Zhao, associate professor of finance who has mentored the university’s student teams since 2005.

Dr. Kevin Zhao

“The S&P 500 total return is a widely used investment performance benchmark of the U.S. stock market,” Zhao said. “It returned 18.4% in 2020. More than 90% of mutual funds in the U.S. failed to beat the S&P 500 index return consistently. Our team beat the S&P 500 total return by a wide margin of 6.2% in 2020.”

The TVA Investment Challenge provides real-world experience for students at 24 participating universities from throughout the region, such as Ole Miss, University of Kentucky, Vanderbilt, and Western Carolina. The student teams manage real funds for the public utility by designing long-term strategies, placing trades, and providing performance reports.

MTSU Economics and Finance professor Kevin Zhao, standing at right, advises students in his Spring 2018 TVA Investment Challenge class inside the Business and Aerospace Building. The annual competition allows college students from universities throughout the region an opportunity to manage a real stock portfolio to hone their analytical skills. (Submitted photo)

MTSU student teams have participated in the Challenge since 2001, with this past year’s team managing a portfolio of 49 stocks. Comprised of students enrolled in the upper level FIN 4900/5900 Tennessee Investment Challenge course, the team earned a “performance award” of $7,731 — a quarter of the excess return beyond the S&P 500 total return.

“The money will go to our department providing extra support for faculty research and student success enrichment activities,” said Zhao, who applauded the “dedicated work” of the students who kept the portfolio’s risk “well controlled through our diversification strategy.”

Prior to 2020, MTSU had received more than $8,000 from TVA for performance awards from its two-decade participation in the program, making the 2020 results all the more impressive. The course draws anywhere from five to 20 students each semester and the portfolio’s success is built upon from semester to semester and year to year, Zhao said.

“We do not gamble or speculate. We do solid homework based on the fundamental analysis approach, which involves macro-economic analysis, industry analysis, and individual stock analysis,” Zhao continued. “Our portfolio is structured according to strategic allocation decisions and individual stock researches conducted by the student team in the class. In 2020, the outperformance of our portfolio is driven by our stock picks in sectors of information technology, communication, health care and financial.”

Students gain ‘successful portfolio and experience’

Alumnus Aidan Black (Class of 2019) of Athens, Tennessee, who served as a student fund manager in 2019, said the experience provides “an excellent opportunity to be a leader in your team and build legitimate fund management experience. This is just as valuable as any internship. Be open to learning new analyses and techniques for improving your skills as an analyst, and you will come away from the challenge with a successful portfolio and experience.”

“This class produces a very supportive atmosphere of students that learn and grow together,” said graduate student Jacob Maguffee of Murfreesboro, a student fund manager for 2020 who’s pursuing his MBA. “This course will take more time outside of the class in comparison to most others, but if you fully invest yourself, it is well worth the experience. I would take it again if I were able to!”

In this Spring 2018 file photo, MTSU student Cody Bottoms does stock research inside a Business and Aerospace Building classroom as part of the TVA Investment Challenge class, an annual competition that allows college students from universities throughout the region an opportunity to manage a real stock portfolio to hone their analytical skills. The stock that Bottom’s student team recommended to invest, Adobe Inc., has gone up in value by more than 150% in two years. (Submitted photo)

Alumnus Jacob Brown of Murfreesboro, also a 2019 student fund manager, advised subsequent classes “to make the most out of the great opportunity that this class is. Unlike many finance classes, what you do in this class has real implications and courses like this are not common. Take advantage of this fact and use these real impacts as motivation for your research and recommendations.”

Dr. Keith Gamble

MTSU finance professor Keith Gamble, chair of the Department of Economics and Finance in the Jones College, applauded the students’ performance.

“Our students’ performance this past year is impressive. They smartly overweighted our portfolio in the best industries for growth despite the ongoing global pandemic,” Gamble said.

TVA created the Investment Challenge in 1998 by allocating $1.9 million to 19 universities to manage in actual investment portfolios. After students demonstrated their skills and results, TVA added schools in 2003 and increased the total portfolio amount to $10 million.

For more information, contact Zhao at 615-898-5473 or kevin.zhao@mtsu.edu.

— Jimmy Hart (Jimmy.Hart@mtsu.edu)

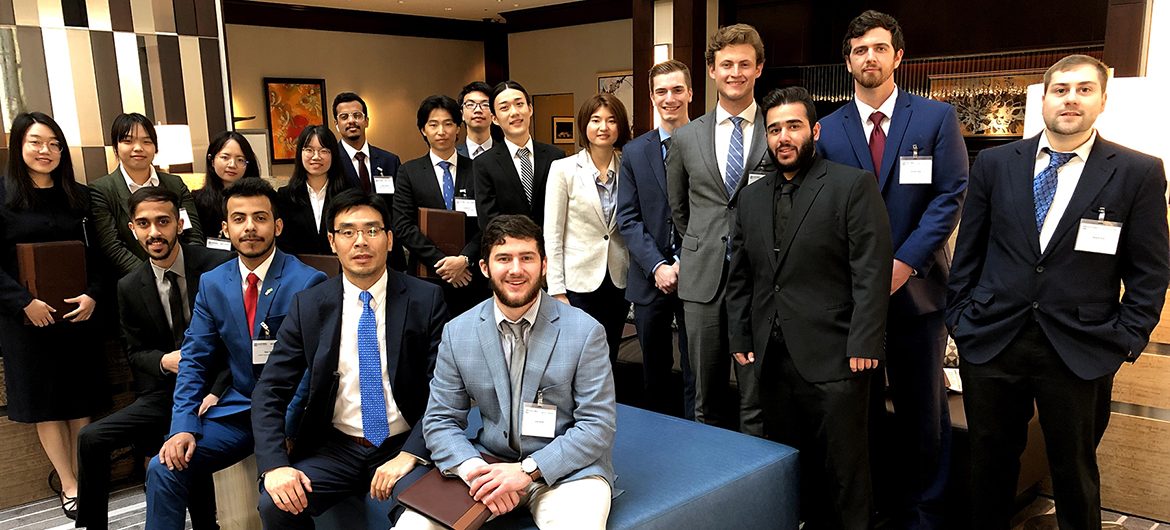

Economics and Finance professor Kevin Zhao, seated in blue tie, is shown with his entire Spring 2019 TVA Investment Challenge class at the TVA’s annual Challenge Conference in Nashville, Tenn. The annual competition allows college students from universities throughout the region an opportunity to manage a real stock portfolio to hone their analytical skills. (Submitted photo)

COMMENTS ARE OFF THIS POST