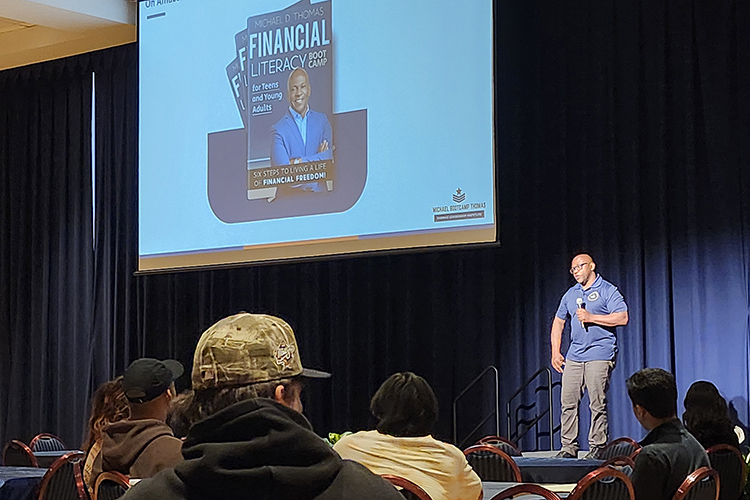

MURFREESBORO, Tenn. — Keynote speaker Michael “Bootcamp” Thomas didn’t mince words with those attending his public talk featured as part of Middle Tennessee State University’s Financial Literacy Month activities.

“Compound interest is a beast,” he told the crowd inside the James Union Building’s Tennessee Room earlier this month at the Department of Economics and Finance event. “Albert Einstein said, ‘He who understands compound interest earns it, and he who doesn’t pays it.’”

Author of the book “Financial Literacy Boot Camp for Teens and Young Adults,” the U.S. Army veteran lived up to his “bootcamp” moniker donning black combat boots, branded blue polo and gray cargo pants as he talked through his slide presentation that included what he dubs “the millionaire code.”

A key part of that code, he told the audience, is starting to accumulate that compound interest by investing, whether in the stock market or through a company 401k, “early … in your 20s,” he said, before pausing to emphasize again to the mostly young audience: “… in your 20s.”

“Five to 10 years delayed can make a huge difference with compound interest,” he said. “This you don’t play with; this is tried and true. … Now with technology, you can do it much faster … but don’t trade this off for something much faster. … This requires delayed gratification.”

Thomas took attendees through his “millionaire code” of doing what you love, automating investments early, starting a side gig to generate more income, creative a passive source of income, and scaling all four of those areas.

“You don’t have to work as hard as you think,” he said, encouraging attendees to continue researching investing through books, podcasts and other sources. “Learn to let the money work for you.”

Ghana native Reina Tetteh, a freshman business administration major with a minor in economics and finance from Smyrna, was initially drawn to Thomas’ talk for extra credit but came away with a new appreciation for building wealth early, even as a college student.

“I really learned a lot about how to build wealth and start investing now, and not wait until after college,” she said. “And building wealth is more psychological than arithmetic based or based on the information you know because you have to make up your mind that you want to build wealth.”

Tetteh said she’s currently taking a personal finance class because she wants to get a handle on eliminating debt as early as possible as she moves toward a professional career, possibly in the accounting field after going to graduate school.

‘Gotta have failure in order to have success’

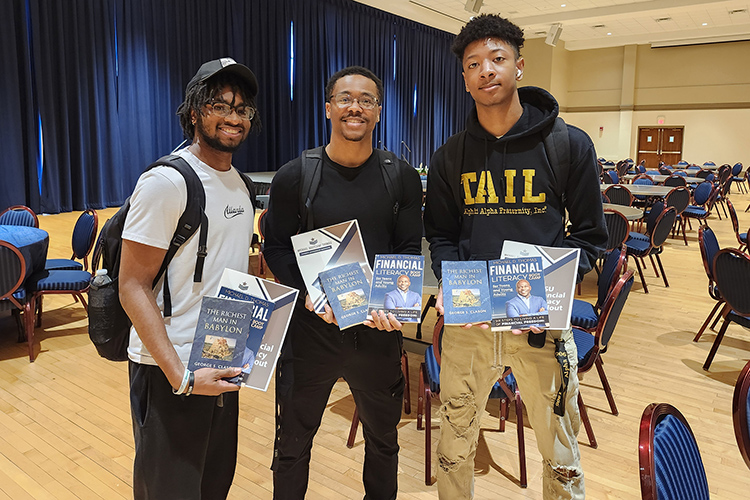

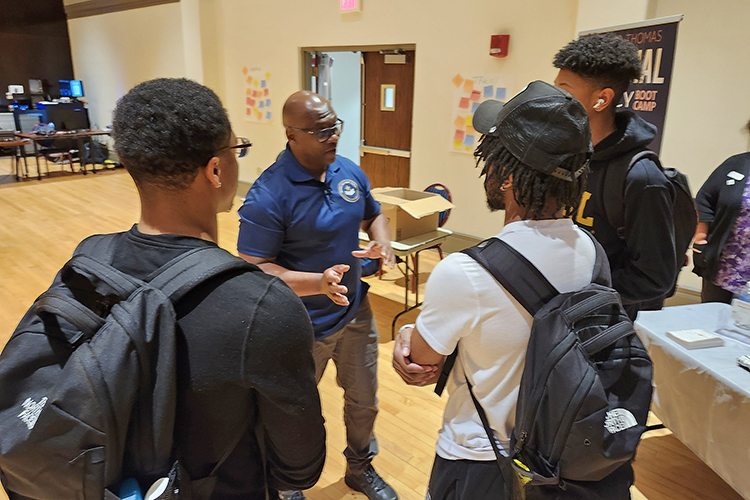

Fellow MTSU students Terrance Taylor, Tyree Brown and Jaylen Few converged on Thomas after his presentation to pick his brain a bit more and all came away impressed with his straightforward approach to talking about finances.

Taylor, a sophomore media management major with a minor in mass communications from Humboldt, hopes to be an executive film producer one day. Taylor said Thomas’ advice gave him better perspective on how to navigate financial issues as an adult and a professional.

He said Thomas’ emphasis on compound interest reminded him of a bad decision to cash out a stock investment to pay for something rather than letting it build value. Lesson learned.

“(Thomas) told me all his flaws, all his achievements, but he said you gotta have failure in order to have success,” Taylor said. “He went into how he had to fail and make some mistakes in order to get to where he is right now.

Brown, a senior interdisciplinary media major with a minor in communications from Nashville, said he hopes to be a human resources specialist in the National Guard, and appreciated Thomas “giving us advice on how to keep focus one task and not be all over the place.”

Few, a sophomore business administration major with a minor in economics and finance from Chattanooga, said he was drawn to Thomas’ breakdown of steps in the millionaire code of “really honing in on that one (area) and perfecting that … to establish a firm (financial) foundation.”

‘He brings a different perspective’

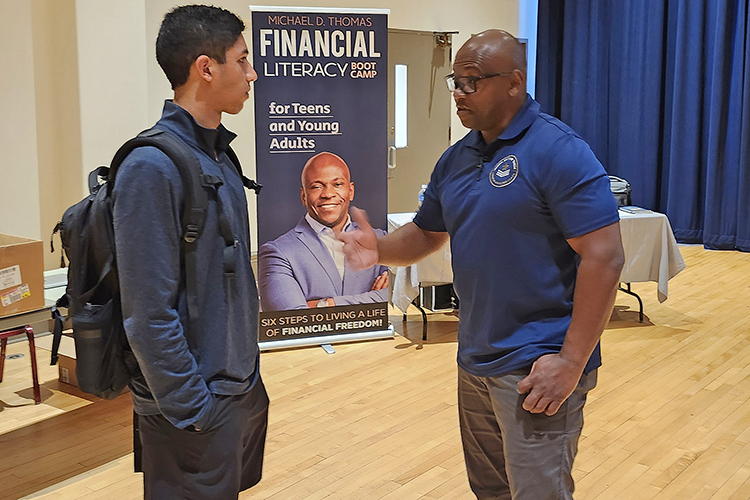

Maria Edlin King, director of the Tennessee Council on Economic and Free Enterprise Education in the Jones College of Business, was pleased with the student questions during the Q&A portion after Thomas’ presentation.

“I think having an outside person is so valuable because they come here and hear ‘professors,’ but here we have someone who is not a professor who may bring a different level of credibility,” King said. “He brings a different perspective.”

The numerous questions from students — from buying their first home to determining best stock choices — confirmed that the presentation struck a chord with many of those in attendance.

“We can have an event with 300 students, but if four of them ‘get it,’ then I consider that a success,” said King, who coordinated a visit earlier in the day where Thomas held a financial bootcamp with over 100 area high school students.

King said Thomas “challenges us to rethink our approach to financial education and to empower ourselves and others with the knowledge and skills needed for financial success and resilience.”

Thomas, who said he’s passionate about spreading practical financial literacy concepts and information to college campuses, was also impressed by the MTSU students’ engagement following his presentation.

“I was thoroughly impressed with the students’ intentional, intense focus as I was walking around and making eye contact … and I saw them taking notes,” he said. “Then when it came to the questions and answers, the quality of the questions, it let me know that they were not only paying attention, but they had a high desire to actually deploy the information in a way that’s going to help them live the lives they are look for.”

Sponsored this year by the Jones College of Business’ Department of Economics and Finance, MT One Stop and Ascend Federal Credit Union, this year’s Financial Literacy Month of activities featured a host of events to help students hone their finance and budgeting skills for the short and long term and even delved into issues such as navigating the world of cryptocurrencies and the increasing use of artificial intelligence, or AI, in financial decisions.

— Jimmy Hart (Jimmy.Hart@mtsu.edu)

COMMENTS ARE OFF THIS POST